Kansas City has a visible market for custom software development. A search returns dozens of providers, local map listings, and companies claiming expertise in business automation. But actually digging into that volume of results reveals a structural gap.

The market serves two ends well: large enterprises with six-figure technology budgets, and businesses that need templated solutions like WordPress sites or SaaS (Software as a Service) platform configuration. Between those two extremes sits a segment of small businesses that neither end of the market is equipped to serve.

This underserved segment of small businesses shares a common profile in that they have outgrown the off-the-shelf tools they started with, but lack the budget or internal IT staff that enterprise providers require. Industries across the metro and region are affected, from Johnson County distributors managing inventory across multiple warehouses, to Jackson County manufacturers whose business logic exceeds what any off-the-shelf platform can accommodate. These businesses need custom operational software built around how they actually operate.

To determine the full scope of this technical “dead zone,” we conducted primary research into the Kansas City software market.

What We Found: Analyzing Kansas City Custom Software Search Results

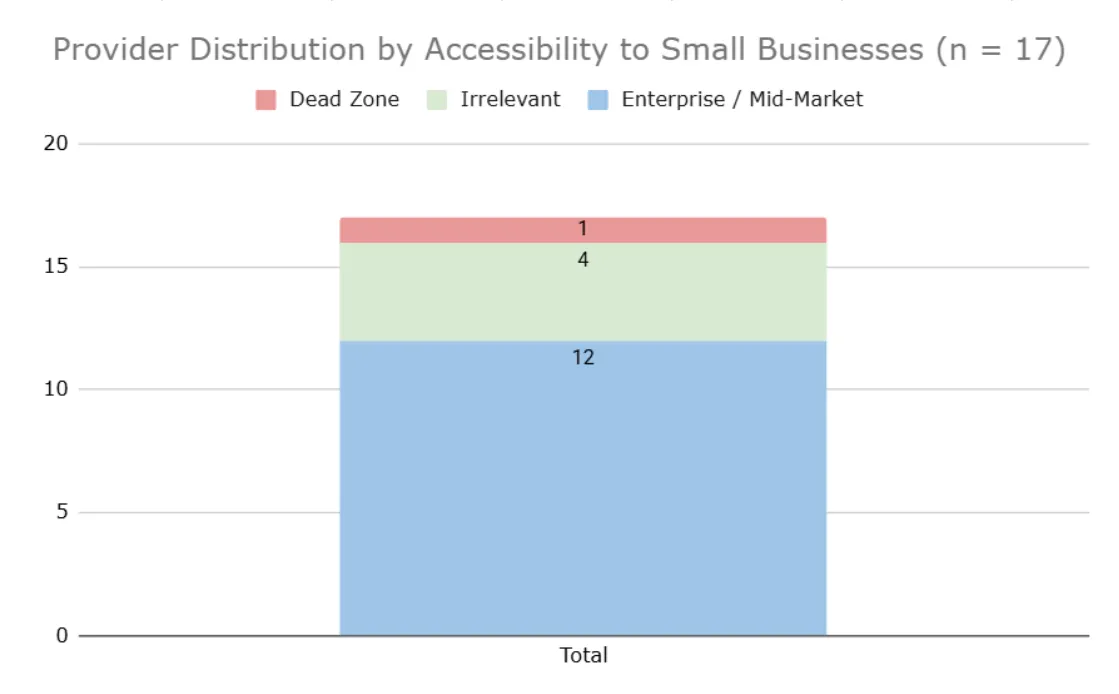

We performed an anonymized search for “custom operational software kansas city” and recorded the top 10 organic results and top 10 map pack results. This produced 20 results (17 unique companies after removing duplicates). We then researched every company individually, evaluating their target market, team size, geographic footprint, client types, pricing signals, and service offerings. Where available, we cross-referenced website claims against LinkedIn data and business profiles to verify company scale and positioning.

Of the 17 unique companies, 13 were relevant to custom business software. The remaining four included an industrial controls manufacturer, a defunct website, a managed IT support company, and a firm using geo-targeted landing pages from out of state with no actual Kansas City presence.

Among the 13 relevant companies, the market breakdown was stark. Three serve enterprises exclusively, with Fortune 500 client rosters and global development teams. Seven more target the mid-to-enterprise range, with multiple office locations, “digital transformation” positioning, and pricing signals that indicate six-figure minimum engagements. One markets explicitly to “small and medium-sized businesses” but employs over fifty people across six locations with an executive team and board of directors — hierarchical complexity that requires mid-market project budgets regardless of what the website copy says. One additional provider positions for the lower mid-market.

Only one company in our analysis genuinely serves small businesses with appropriate scale, actual Kansas City metro presence, and relevant custom software capability.

Why the Dead Zone Exists

The scarcity is not because small businesses lack budgets or do not need custom systems. It exists because the economics of serving this market require a business model that most providers cannot or will not adopt. The dead zone forms where two constraints meet and squeeze out the middle.

The Enterprise Cost Structure

Enterprise providers cannot serve small businesses profitably. When a company employs project managers, account managers, business analysts, designers, and specialized developers across multiple office locations, monthly overhead demands six-figure projects just to break even. A forty-thousand-dollar engagement does not cover operating costs, let alone generate profit. This is not greed or price gouging. It is arithmetic.

Some Kansas City enterprise firms claim they work with startups alongside larger clients, and perhaps they do occasionally. But when a company features Fortune 100 clients prominently and uses phrases like “digital transformation consulting” and “enterprise architecture,” a Johnson County manufacturer with fifteen employees is not their target customer regardless of what the homepage copy suggests. The project approach does not scale down well.

The Capability Floor

At the accessible end of the market, the constraint is capability rather than cost. Smaller providers have built viable businesses around services that work at scale for them: WordPress sites, SEO, platform configuration, and basic integrations. These services have their place and serve an existing need, but they are not custom operational software. When a business needs systems that model specific workflows, enforce unique business rules, and integrate deeply with existing tools, platform limitations become the constraint. No amount of plugins, integrations, or configuration can overcome fundamental architectural boundaries.

Why the Middle Is So Rare

Enterprise firms serve large companies profitably by maintaining the infrastructure those clients expect. Accessible providers serve smaller businesses profitably by offering repeatable, templated solutions. Both models are economically viable. But the business that needs genuinely custom operational systems at small business scale falls between them: the enterprise approach is economically inaccessible, and the commodity approach is technically insufficient.

Serving the middle requires a specific kind of provider: someone with enterprise-level technical capability who operates with minimal overhead, typically a founder-practitioner rather than a traditional agency. That business model is viable, as the few providers who have adopted it demonstrate, but it is rare because it requires an unusual combination of deep technical skill and willingness to work directly with small business clients at smaller project scales.

Why the Search Experience Obscures the Dead Zone

The gap would be easier to navigate if search results reflected it honestly. Instead, several patterns in the Kansas City search landscape make the dead zone difficult to recognize.

Geo-Targeted Local Pages

Companies use geo-targeted landing pages to appear in Kansas City searches despite having no actual office in the metro. In our results, one company ranking prominently operates from Pennsylvania with no Kansas City presence, its URL simply appending “/local/mo/kansas-city” to create the appearance of a local page. Others headquartered in Illinois or overseas use Kansas City-specific URLs that suggest local expertise but represent only an SEO strategy. A business owner looking for a local partnership will waste time contacting providers who cannot offer one before discovering they have no actual presence here.

Contradictory Positioning

The most confusing pattern involves companies whose marketing contradicts their structure. In our results, one firm markets explicitly to small and medium-sized businesses while employing between fifty and two hundred people across six locations with an executive team and board of directors. Their messaging targets small businesses, but their infrastructure requires project budgets that reflect their overhead. Their website gives no clear way to determine whether a given business is the right size client or whether their definition of “small business” matches reality.

Results That Are Not Custom Software

Even a specific search for “custom operational software” returns results that have nothing to do with custom software development. Managed IT support companies, industrial hardware manufacturers, and defunct websites all appeared in our results. Each is something a business owner must investigate and discard before reaching a relevant provider.

The combined effect is that the volume of search results creates an illusion of choice where very little actually exists for this market segment. The problem is not a lack of search results. It is that the results mask the dead zone instead of revealing it.

How to Evaluate Custom Software Providers in Kansas City

Understanding the dead zone changes the approach to finding help. The search is not for better keywords or different directories, but for the small number of local providers whose business model allows them to serve this market segment. Several signals help distinguish them.

Direct Client Relationships

Providers who work directly with clients rather than through layers of account management tend to be better positioned for small business engagements. When a business owner communicates with the person who will actually do the work, it eliminates the overhead and communication gaps that drive up costs and create misalignment. This direct model is often what makes serving the small business market economically viable. If the primary point of contact is an account manager who relays questions to a development team the client never meets, the provider’s structure is likely built for larger engagements.

Verified Small Business Clients

Evidence of actual small business clients matters more than marketing copy that mentions small businesses alongside enterprise case studies. Case studies and client lists reveal who a provider actually serves, which is more reliable than who they claim to serve. If every example client is a large corporation or national brand, that signals something about typical engagement size regardless of what the positioning statement says. The most useful indicator is specific examples of businesses similar in size and complexity.

Provider Scale

The provider’s own size signals economic realities. A company with ten to twenty people often has the capability to handle sophisticated technical work while maintaining the cost structure that makes small business projects viable. A company with hundreds of employees across multiple locations almost certainly has overhead that requires larger projects. Size is not inherently good or bad, but it directly affects whether a given project makes financial sense for both parties.

True Kansas City Presence

If local presence matters, it should be verified. Physical office locations in the metro, local staff, and evidence of in-person client work with Kansas City area businesses are the relevant signals. Geo-targeted landing pages claiming Kansas City expertise are easy to create and reveal nothing about actual local capability or understanding of the regional business environment.

Operational Systems Expertise

Building operational systems requires understanding how businesses actually function: how work flows through organizations, where information gets trapped, and how decisions get made. This is different expertise than building marketing websites or configuring SaaS platforms, even when the same technologies are involved. If the challenge involves automating workflows, connecting disconnected tools, or building systems around specific business logic, the provider’s core competency should be operational software, not marketing services that happen to offer custom development as an add-on.

Summary: Provider Evaluation at a Glance

The signals below are not rules, but consistent patterns we observed when comparing providers that can serve small businesses versus those structured for enterprise clients.

| Red Flags | Green Flags |

|---|---|

| Multiple office locations across states | Single or regional office in KC metro |

| 50+ employees with executive/board structure | 10-30 employees, flat structure |

| Only Fortune 500 case studies | Small business case studies ($500K-$10M revenue) |

| “Digital transformation consulting” language | “Operational systems” or “business automation” focus |

| Account manager as primary contact | Direct access to technical lead or owner |

| Geo-targeted landing page, no local address | Physical KC address, in-person capability |

| Generic “small and medium business” claims | Specific examples of similar-sized clients |

| Marketing/web focus with “custom software” add-on | Custom development as core competency |

The Dead Zone Exists, but Is Not Absolute

The Kansas City custom software market has a structural gap in the middle. Our research confirms it: of 17 companies appearing in local search results for custom operational software, only one genuinely serves small businesses at appropriate scale with actual local presence. The search experience itself obscures this scarcity behind geo-targeted pages, contradictory positioning, and results that have nothing to do with custom software.

But the dead zone is not empty. Providers who have found a viable model for this market demonstrate that it can be served well. Recognizing the gap is the first step; knowing what to look for in a provider is the second.